Nieman Journalism Lab |

- New numbers from The New York Times: A gold star for managing the digital transition

- The newsonomics of newspapers’ slipping digital performance

- Facebook teams with Storyful to highlight news content published on the social network

- “Can Philanthropy Save Journalism?”

| New numbers from The New York Times: A gold star for managing the digital transition Posted: 24 Apr 2014 02:54 PM PDT Look at The New York Times Co.’s Q1 earnings report, released and webcast today, this way: The Times — for now — is doing an above-average job of managing the print-to-digital transition. Several pieces of data confirm that belief. A couple of numbers tell us a lot: In the first quarter, the Times took in $40 million in digital-only subscription revenue. That number has been growing; it ended up at about $150 million for 2013. But in that same quarter, the Times’ overall circulation revenue increased by only $4 million, year over year. On the face of it, the numbers don’t make sense. Why is the overall circ revenue increase so small, given how much digital circ revenue continues to grow at a good pace — 18 percent year over year, now creating a paid digital-only circulation number of 799,000? Put simply, print circulation continues to tumble dramatically. It’s down in copies sold — 6.5 percent daily, 2 percent Sunday. While the Times put more print price increases into the market over the last 15 months, its print readership continues to drop rather dramatically. The Times is still growing digital-only circulation (albeit at lower prices than in print), reporting 799,000 than print. It added more net digital subscribers in the first quarter of 2014 than in any quarter in 2013. But the key element is successfully — if only marginally — managing this transition. The goal: Keep that reader revenue growing, even as the Times loses paid (and higher priced) print. One important point: The cost of fulfilling those digital subs is far lower than the print ones. That’s the 2018-20 story: Get to that future fairly intact, and the business becomes far more profitable. This is the story the Financial Times — in many ways the Times’ model — has been able to start telling. In its last report, it reported only a 1 percent increase in revenues, but a 17 percent jump in profit. Farther along in the digital transition, its profit picture is improving more quickly. One other data point tells us about this tightrope transition success: The Times reported a 4 percent print ad revenue increase for the first quarter. The entire newspaper industry lost 8.6 percent of its print revenue last year (see today’s earlier story, “The newsonomics of slipping digital performance”), so being up 4 percent is significant. Times Co. CEO Mark Thompson made a major point of April being a tough month and the ad waters still being very choppy. (In other words, don’t expect 4 percent growth again in Q2.) But for Q1, consider that the Times is shedding lots of print customers, but still growing print ad revenue and managing to still grow reader revenue. Give Thompson one gold star for now: His first mandate is to improve revenue growth, and this is the third quarter in a row he’s done that. Many challenges, and rocks, lie ahead:

Tomorrow, a conference in New Jersey, “Innovating the Local News Ecosystem” (livestream tomorrow at 9ET here, #innovatelocal on Twitter), will focus on those local challenges and opportunities. Sponsored by the School of Communication and Media at Montclair State University, it has a packed agenda (I’m on a morning panel with USA Today publisher Larry Kramer, Jim Brady, Tiffany Shackelford, and host/Montclair State school director Merrill Brown). Still, what we’re learning from The New York Times, across the Hudson, shouldn’t be too far from our conversation. Photo of The New York Times Building by Alexander Torrenegra used under a Creative Commons license. |

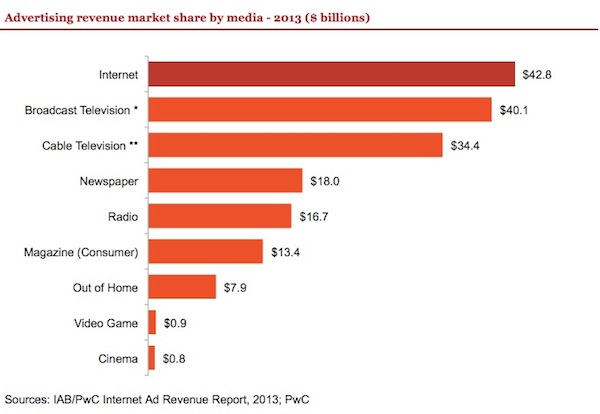

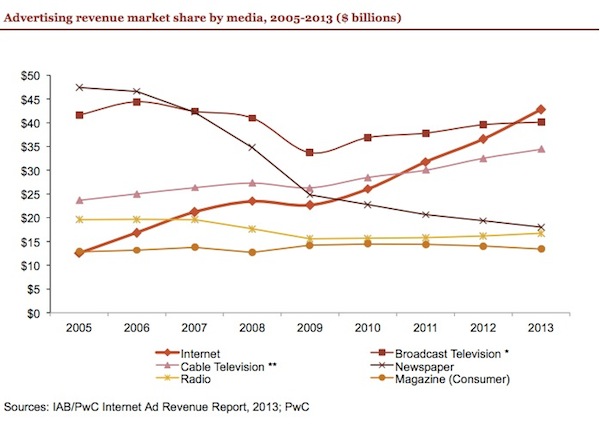

| The newsonomics of newspapers’ slipping digital performance Posted: 24 Apr 2014 07:30 AM PDT As we approach the middle of the 2010s, where do newspapers fit in the battle for America’s largest ad sector — digital? And how well are all those paywalls doing? Two reports tumbled into the public sphere within a week of each other recently, and together, they help us answer both questions. The numbers here show that the newspaper industry overall — a relative minority of leading-edge players aside — is trending the wrong way. Both digital ad revenue and reader revenue continue to grow, but both are less positive than they were a year ago. Let’s start with the overall digital ad market. The Interactive Advertising Bureau’s 2013 full year report is its usual rosy self. Ten years ago, IAB had to explain what it was. Now, it tracks the country’s No. 1 ad type — digital. Digital ads passed broadcast TV for the first time, and by a healthy margin, $2.7 billion. Passing TV is another milestone, coming just a year after digital surpassed print (newspaper + magazine) spending. Now, its lead over newspapers, as seen in the IAB chart below, is more than two to one, $42.8 billion to what IAB counts as newspapers’ $18 billion.

Curiously, that last number — part of a study PwC (PricewaterhouseCoopers) did for IAB — counts $5.8 billion less in overall newspaper advertising than does the Newspaper Association of America (NAA), which released the other big summary 2013 report. That’s a big difference — 25 percent. How come? (“It was sourced within PwC data,” offers PwC’s Steven Silber in explanation.) Metrics are a big issue in the web world, but this ad delta — print and digital combined — is an outsized one. Whichever number you want to use — $23.8 billion or $18 billion — is highly meaningful. But your choice won’t change our tale much. The gulf between digital and newspaper advertising is now enormous, and still growing: Digital advertising grew 17 percent year over year. The graphical time series reinforces the numbers and puts squiggly lines to the lost decade for newspaper companies:

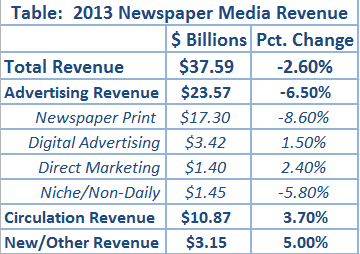

There’s a lot more in the report than the top-line numbers, and we’ll get to some of that below. First, though, let’s compare the IAB report with that NAA report that came out at the end of last week. Let’s start with the NAA’s digital ad number. It came in at $3.42 billion, an increase of only 1.5 percent year over year, shown below in the context of other 2013 revenue categories. (Note: The direct marketing and niche publication data is all print; any digital niche revenue would be in “digital ads.”)

That’s a fairly incredible number. But it’s not a surprising one. Each newspaper company reports (and internally allocates) its digital ad revenues by its own standards, so it’s tough to get apples-to-apples comparisons about how well these publicly reported numbers differ company by company. (Not to mention the many newspapers going private and only selectively releasing any data at all.) Is McClatchy’s digital-only revenues report significantly different than Gannett’s, or A.H. Belo’s? What we can see in this NAA assemblage of numbers is that digital advertising growth has become an increasing challenge for all newspaper companies. NAA’s compilation is a fairly comprehensive extrapolation, based on 24 newspaper media enterprises, including all the public companies and some private ones. Its aim: to “cover all regions of the country and all circulation size groups.” It shows this troubling trend in digital ad revenue growth over the past few years:

That takes us back to the recession-wracked year of 2009, when overall advertising dropped 19 percent — and that’s what took the breath out of the industry. Digital advertising, unsurprisingly, declined 11.8 percent that year. Before that, it all felt like upside: Digital ads grew at annual rates between 18 percent and 31 percent between 2004 and 2007. This is where we need a New Yorker cartoon: Silver-haired mid-aughts newspaper CEO standing in front of chart, presiding at an impressively long, carved from a single exotic tree and flown in from wherever, whatever-the-expense, table. Pointing to a drawn five-year spreadsheet, he’s saying, “Yes, the down arrow of print advertising is regrettable, but manageable. Look at the up arrow of digital ad growth! As you can see, we’ll hit a crossover point of digital ad growth surpassing print ad decline, and all will be well.” It didn’t work out that way. Few of those CEOs are left. The digital ad arrow rocketed higher and at a sharper angle than nearly anyone would have believed 10 years ago. But newspapers didn’t benefit from the boom. And the newspaper print ad arrow plummeted, a fall that now looks stuck at about an annual 8 percent rate. What was once was the great growth hope is now a popped balloon. The digital ad war looks almost over. Newspapers haven’t lost, exactly — $3.4 billion is still a lot of money — but they have been reduced to supporting player status. Digital advertisingPut a few numbers together and we can see that newspapers take only about 8 percent of all digital ad spending, a share that’s clearly in decline. In the old pre-Internet world, newspapers took about 20 percent of overall ad spending. Those two numbers are another shorthand to understand the destruction of the industry’s core business, as advertising once supplied 80 percent of the industry’s revenues and nearly all its profits. Take in these numbers from the IAB report:

It’s important to say: A relative few leading-edge newspaper company players are growing digital ads in high-single and even low-double percentages. Those are the companies I usually dwell on in my work, in this column and at Newsonomics.com, the best practice examples that may push faster innovation for others. Those companies are using a new portfolio of good techniques, deploying advanced ad technology and optimization, selling local digital marketing services, and retooling their sale forces to widen and deepen relationships with advertisers. One brighter spot the NAA numbers can point to: Digital agency and marketing services grew 43 percent, albeit off a still-small base (“The newsonomics of selling Main Street”). This week, though, it’s essential to face the average reality for the industry. That 1.5 percent digital ad growth rate says volumes. Most companies simply aren’t executing at a transformative level, and their continued cutting of staff and product reinforces that often dismal reality. A few have prioritized print over digital — the Orange County Register’s Eric Spitz is the most vocal in that camp. Most, though, are trying to focus on digital — they’re just not succeeding. The IAB data tells us something else about the 2015-18 digital ad ecosystem: Publishers may succeed best by aligning themselves with one or several of the top 10 players. Those players’ ad tech so far surpasses most publishers’ that partnerships — and using others’ tech and reach — become essential. Take the Local Media Consortium, which grew out of major newspaper publishers’ relationship with Yahoo ad tech. It now uses Google’s DoubleClick Ad Exchange, as do many other individual chains and papers. Google is a foundation for their digital businesses. Then there’s Facebook, now building itself into an ad network, which will no doubt be used by newspaper companies. (Many of them already resell Facebook advertising.) Riding along — finding the most profitable place nesting within the biggest ad players — is much of the future of local newspaper companies’ digital ad future. Digital and all-access circulationFinally, let’s get back to that other growth area for newspaper companies, what I have identified as the revolution of reader revenue. NAA reported an increase of 3.7 percent in circulation revenue. That surprised me. I’d expected it would come in around 4-5 percent. Why? By the end of 2013, more than four in 10 U.S. dailies had restricted digital access in some form, including almost all the chains other than Advance. Some charge extra for digital access; many include it as part of single-priced print-plus-digital sub. The singular compelling idea: Get more reader revenue to help offset the awful decline of print ad money. While 3.7 percent is good, up from the flat circulation revenue we saw in 2008-10, it’s a point less than the 4.5 percent circulation revenue growth in 2012. There are lots of moving pieces with reader revenue, but looking at individual company numbers, it looks like reader revenue growth may already be slowing — and that would be bad news for publishers still searching for a way to first get to zero revenue growth — and then, hopefully, positive revenue growth. Let’s also remember that The New York Times’ reader revenue number is included in that 2013 over 2012 NAA industry increase of $430 million. The Times increased its overall circulation revenue by $51 million in 2013 — so that’s 11 percent of NAA’s increase right there in one paper. (For context, The New York Times’ circulation revenue equals about 7.5 percent of all U.S. circulation revenue. For clarity, the Times’ 2013 net increase in reader revenue was $51 million, despite its reporting of what is now a $160 million run-rate in digital-only subs. The $100-million-plus difference? The Times, like all dailies, continues to lose print subscribers, and their money. Just this morning, in its 1Q earnings call, the company noted that print circulation dropped 6 percent in daily copies, 2.5 percent on Sunday. So figure this: For every two dollars lost in print reader revenue, it is gaining three in digital. That’s a tough tradeoff, but one that seems to be working. In fact, with print advertising just reported to be 4 percent up for the first quarter, the Times is doing decently in print overall.) Why might reader revenue increases be slowing, a topic that needs to be deeply explored? Consider these possibilities:

It’s too early to know what’s yet true, among that mix-and-match set of possible scenarios. Something, though, seems afoot. One could say the numbers are sobering. But this is an industry that was shocked into sobriety years ago. Overall, NAA put the best face it could on its numbers, noting industry revenue was only down 2.6 percent. That’s still down, though, and those digital ad and reader revenue growth rates are going in the wrong direction. It’s a performance that may raise new questions for the spate of new owners, and the would-be buyers of properties on the market or soon to come to market. As the industry sells off Cars.com, newspaper sellers may find its hard to put a fresh gloss on a used paper. Photo by Ian Koppenbadger used under a Creative Commons license. |

| Facebook teams with Storyful to highlight news content published on the social network Posted: 24 Apr 2014 07:00 AM PDT Facebook and Storyful are partnering to create a newsfeed of newsworthy content, originally published on Facebook by its users, to encourage journalists to use the social media site as a source of user generated content. Called FB Newswire, the new Facebook page will be available publicly and updated in real time with photos, videos, and status updates across a spectrum of topics, including breaking news, entertainment, and sports. Posts will also be shared on, ironically enough, a dedicated Twitter account. The newsfeed is part of Facebook’s effort to continue to market itself to journalists as a news-gathering tool.

“In addition to the value we’re delivering with referrals, if we can help surface content that is relevant to the journalism that they are creating, that will just further the relationship between Facebook and the news industry,” Mitchell said. When looking for user-generated content, many journalists might first look to places like Twitter and YouTube over Facebook — not least because Facebook posts often come with some level of privacy settings. Still, there are 2.46 million pieces of content posted to Facebook per minute, and Facebook wants to emphasize the wealth of what is available on the social network. (Facebook also owns the photo-sharing service Instagram, but FB Newswire will be initially limited to just Facebook content.) FB Newswire is just the latest move Facebook has made in recent months to promote newsworthy content as it has tweaked its News Feed and search algorithms, introduced trending topics, and added hashtag functionality. Facebook’s recent Paper app also drives home the social giant’s increased interest in the news space. Even as Twitter gets ragged on in some corners for a Facebookish redesign, Facebook is clearly trying to take some of the news mojo that Twitter’s built up. As David Leonhardt, editor of The New York Times’ new The Upshot, put it to us this week:

Facebook decided to partner with Storyful because it specializes in locating and verifying user generated content from across the social web: “This is basically what they do,” Mitchell said. “This is their reason for being. They've developed an expertise.”

Each post on FB Newswire will allow users or news organizations to embed posts like any other Facebook post, but it will also link back to the Facebook page where the content originated. Storyful will provide short written context for each post as well as relevant hashtags. Users will also be able to comment on the FB Newswire posts, and Kerr said Storyful is looking forward to the feedback journalists will be able to provide on the content they post. Kerr said Storyful’s goal is to provide newsrooms with access to content and information that they might not typically have access to. “We want to start to help users and newsrooms tell stories from different parts of the world,” she said. Photo of a woman taking picture of a protest in Egypt by Darla Hueske used under a Creative Commons License. |

| “Can Philanthropy Save Journalism?” Posted: 24 Apr 2014 06:30 AM PDT Philanthropy Magazine, the magazine of the Philanthropy Roundtable, dedicated its newest issue to a question very familiar to Lab readers, albeit usually expressed in a less absolutist form: “Can Philanthropy Save Journalism?” The upheaval in the traditional business model for journalism has meant a rapid rise of nonprofit news outlets. That, in turn, has led to questions about how those outlets can find sustainability for the long term — or just gain 501(c)(3) status. The magazine wanted to pull back and ask a few big questions:

The issue features a contrarian take from the oft-contrarian former New York Sun editor Seth Lipsky, who argues that news organizations need a profit motive to be self-reliant. Lipsky writes:

Another feature goes around the horn to take a look at the state of nonprofit newsrooms and the funders behind the scenes, including ProPublica, the Texas Tribune, First Look Media, and MinnPost. The issue also looks at how a donor-funded conference, the Faith Angle Forum, provides reporters with insight into religious issues that may cross into their coverage areas. You can find all the stories here. |

| You are subscribed to email updates from Nieman Journalism Lab To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

So, as digital advertising overall grew by $6.2 billion in a year, newspapers’ digital ad take increased by only $50 million — less than one percent of that six-billion-dollar growth.

So, as digital advertising overall grew by $6.2 billion in a year, newspapers’ digital ad take increased by only $50 million — less than one percent of that six-billion-dollar growth.

![FB Newswire_news1[1]](http://www.niemanlab.org/images/FB-Newswire_news11.jpg) Facebook is of course a major source of traffic referrals for many news organizations — half of BuzzFeed’s

Facebook is of course a major source of traffic referrals for many news organizations — half of BuzzFeed’s ![FB Newswire_viral1[1]](http://www.niemanlab.org/images/FB-Newswire_viral11.jpg) For Storyful, which will run the page, FB Newswire serves as an opportunity to showcase its brand and products to a larger audience, said

For Storyful, which will run the page, FB Newswire serves as an opportunity to showcase its brand and products to a larger audience, said